Seamless Open Banking Implementation with ONFTECH

The Roadmap to Open Banking Success in KSA: A Step-by-Step Approach

In today's digitally driven world, Open Banking has emerged as a transformative force, revolutionizing the financial landscape by fostering collaboration, innovation, and enhanced customer experiences. However, while the benefits of Open Banking are abundant, the journey towards its successful implementation requires careful planning, strategic execution, and a deep understanding of both technological and regulatory landscapes.

This step-by-step guide explains the key requirements to be considered while implementing open banking and how ONFTECH helps banks to implement the open banking platform.

The Roadmap

The first step for the bank should be to define the vision and collaborate with the right partner, and the following points are critical.

Clear Vision: The foundation of any successful Open Banking implementation lies in a clear vision and a well-defined strategy. Institutions must articulate their objectives, whether it's driving innovation, improving customer experiences, or expanding market reach.

Right Partner: The journey towards successful Open Banking implementation is fraught with challenges, ranging from technical complexities to regulatory compliance. This is where ONFTECH steps in, offering a suite of cutting-edge technologies and services designed to streamline and empower every aspect of the Open Banking journey.

Compliance and Regulation: Compliance with regulatory requirements is non-negotiable in Open Banking. Institutions must stay abreast of evolving regulations such as PSD2 or similar country base mandates. Compliance efforts should not be viewed as mere obligations but as opportunities to enhance security, privacy, and trust among consumers.

Step 1: Define your Vision

Now let's look at the benefits of open banking services for banks and Fintechs.

Enhanced Financial Transparency: Open banking allows consumers to have better visibility into their financial data by providing access to all their banking information in one place.

Increased Competition: By fostering an environment where multiple financial institutions can securely access and share financial data, open banking promotes competition in the financial services sector.

Innovation and Product Development: Open banking encourages innovation by enabling third-party developers to build new financial products and services using aggregated banking data. This can lead to the development of innovative solutions such as personalized financial management apps, budgeting tools, lending platforms, …etc.

Streamlined Account Access: With open banking, consumers can grant permission for third-party providers to access their financial information securely. This eliminates the need for manual data entry and allows for seamless integration between different financial accounts and services.

Better Risk Assessment: By leveraging a broader set of financial data, lenders and financial institutions can improve their risk assessment processes. This can lead to more accurate credit scoring, reduced default rates, and ultimately lower borrowing costs for consumers.

Empowerment of Consumers: Open banking puts consumers in control of their financial data, allowing them to decide who can access it and for what purposes.

Step 2: Partner Contribution

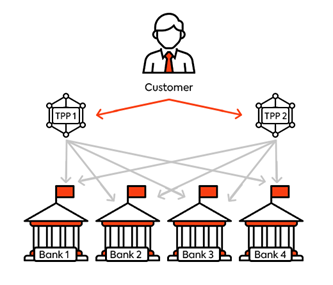

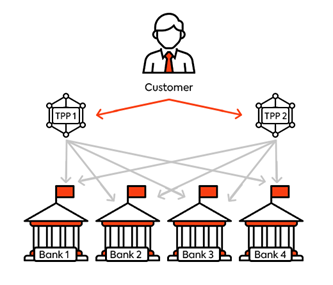

Open Banking services in Saudi Arabia scale to serve a growing customer base, ONFTECH as a SAMA certified TSP (Technical Service Provider) with its product, OBridge gives scalable solution designed for resilience and performance.

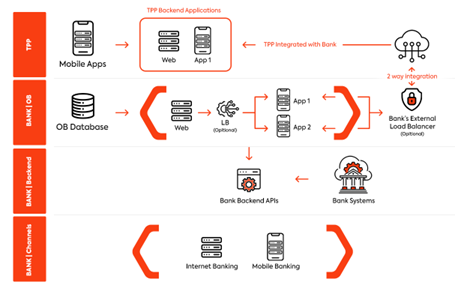

API Development and Integration: OBridge provides a comprehensive way for implementing, deploying, and managing APIs tailored to the needs of Open Banking KSA Standard. With support for industry standards like OAuth 2.0 and OpenID. ONFTECH enables secure and standardized data exchange while facilitating seamless integration with existing banking systems.

OBridge supports mutual TLS (mTLS) authentication to secure communications between all parties. Security measures of OBridge ensures that both the client and server authenticate each other using digital certificates, mitigating the risk of man-in-the-middle attacks and unauthorized access to sensitive data.

OBridge - Developer Portal: This provides a user-friendly interface for developers to discover, explore, and consume APIs, developing their solutions and fostering collaboration and innovation within the Open Banking ecosystem.

Multi-Factor Authentication (MFA): ONFTECH integrates multi-factor authentication (MFA) mechanisms, including SMS, OTP etc., to enhance user authentication security. This mitigates the risk of unauthorized access to banking systems.

OBridge - Back Office Portal: This portal for open banking would serve as a centralized platform for managing various aspects of open banking operations, compliance, and administration for banks. Backoffice portal have some key features like below.

Third-Party Management: When a third party wants to consume APIs from banks, they will come to the bank’s developer portal where they can explore existing APIs that are published and see what is available to develop their applications. When they actually want to use these API’s they have to initiate on boarding process to be registered third party with the bank.

Incident Management System: For open banking, incident management systems are needed to identify, prioritize, respond and resolve tickets coming from the developer portal / onboard process / Active TPPs. And ONFTECH open banking solution has well designed incident management system.

APIs - Consent Management: Onftech's open banking solution has consent management system to empowers customers to control how their data is shared and used, enabling institutions to obtain and manage consent in a transparent and compliant manner, enhancing trust and accountability.

APIs - Consent Revocation: Onftech open banking solution has consent revocation mechanism for both user and banks. Three ways have been identified to revoke the given user consents:

The bank provides a screen to bank users to revoke the consent when the customer comes to the bank and asks to revoke the consent.

The bank provides a screen at internet/mobile banking application for bank users to log in and revoke the consents.

The bank provides an API to revoke the consent so that TPP can provide a revoking functionality through their applications.

APIs - Audit Trails and Logging: Onftech's open banking solution has maintains detailed audit trails and logs of all API transactions, user activities, and system events. This ensures transparency and accountability, facilitating regulatory audits and investigations.

APIs - Automated Regulatory Reporting: Onftech's open banking solutions automates the generation and submission of regulatory reports required by SAMA, like transaction reports, service availability reports. This reduces the administrative burden on financial institutions and ensures timely compliance with regulatory deadlines.

Step 3: Compliance and Regulation

There are some infrastructural requirements that a bank needs to consider about an open banking architecture. Let’s check Infrastructural Requirements at this step.

Horizontal Scalability with Load Balancing: ONFTECH designs the on-premises infrastructure for horizontal scalability, leveraging load balancing techniques to distribute incoming traffic across multiple API instances. This ensures optimal resource utilization, fault tolerance, and scalability, enabling financial institutions to handle fluctuating workloads and accommodate growing user demand without compromising performance or availability.

High Availability and Disaster Recovery: ONFTECH designs infrastructure architectures with redundancy, failover mechanisms, and disaster recovery capabilities to ensure high availability and business continuity. This mitigates service disruptions and downtime risk, even in hardware failures or natural disasters.

Conclusion

In conclusion, the journey towards successful Open Banking implementation in the dynamic landscape of Saudi Arabia demands a meticulous approach, combining strategic vision, technological prowess, and regulatory compliance. As elucidated in this comprehensive guide, the roadmap to Open Banking success encompasses defining a clear vision, selecting the right partner, and adhering to stringent compliance standards.

With ONFTECH's cutting-edge solution “OBridge” and expertise, banks can seamlessly integrate into the Open Banking ecosystem, harnessing the transformative power of collaborative innovation. From API development and integration to consent management and regulatory reporting, ONFTECH provides a robust framework for banks to navigate the complexities of Open Banking with confidence and agility.

As financial institutions embrace the opportunities presented by Open Banking, ONFTECH stands ready to empower them on their journey, ensuring resilience, scalability, and security every step of the way. By choosing ONFTECH as their trusted partner, banks can unlock the full potential of Open Banking, revolutionizing customer experiences and driving sustainable growth in the digital era.

- Written by İbrahim Özbey, Chief Technology Officer at ONFTECH